The Debt Based Economic Machine

Jump into the MoneyVerse and uncover the secrets of macroeconomics, digital assets, and decentralised finance.

The first law of thermodynamics states that energy cannot be created or destroyed.

For example, when SBF’s mighty cell shuts behind him, the massive CLANG of the lock banging into place is not freshly created sound energy but a transfer of kinetic energy from the arm of the prison guard to the kinetic movement of the door, to the metal-metal connection that generates thermal heat, and finally, to the vibration of particles in the air. For any action, reaction, or transaction, energy is simply transferred or transformed from one form to another.

So why are we talking about physics in a financial newsletter? Good question, in fact, let me do the old uno reverse and ask you a question. Do you think money follows a similar system? Does money continuously flow from one source to the next? And more importantly, can money be created or destroyed? Well, let’s find out.

For this week’s newsletter, we will break down the (rather fucked) fundamental laws of the modern-day economy - The Debt Based Economic Machine.

The Debt Based Economic Machine

In 1975, 26-year-old Raymond Thomas Dalio founded Bridgewater in his two-bedroom apartment. 48 years later, Bridgewater Associates is the world's largest Hedge Fund, with over 123.5 billion in assets under management. “What a baller” I hear you say. So, what secrets did this gigabrain gentleman learn to generate this staggering sum of wealth?

It was pretty simple really - Ray realized that everything is cyclical. Whether nature, human behavior, or money, everything has its own system that flows around in neverending cycles. The cycles aren’t always the same, but they possess the same characteristics over, and over, and over again. It was via looking back at history and thoroughly analyzing and combining both short-term and long-term cycles that Ray managed to position himself (and the fund) to reap the massive upswings when they came.

It’s Ray's ineffable understanding of the economic machine that has got him where he is today. Besides being worth billions, he has also written 3 best-selling books that break down how the money cycle operates, how geopolitical tensions rise, and how just like money cycles, empires are cyclical too. Each of these books has also been condensed into animated videos like the one above. It’s a banger - watch it!

For this week’s newsletter, we will use this resource to uncover how the modern-day money cycle works and look at additional resources to take an educated guess on where we are in the cycle.

The 3 cycles

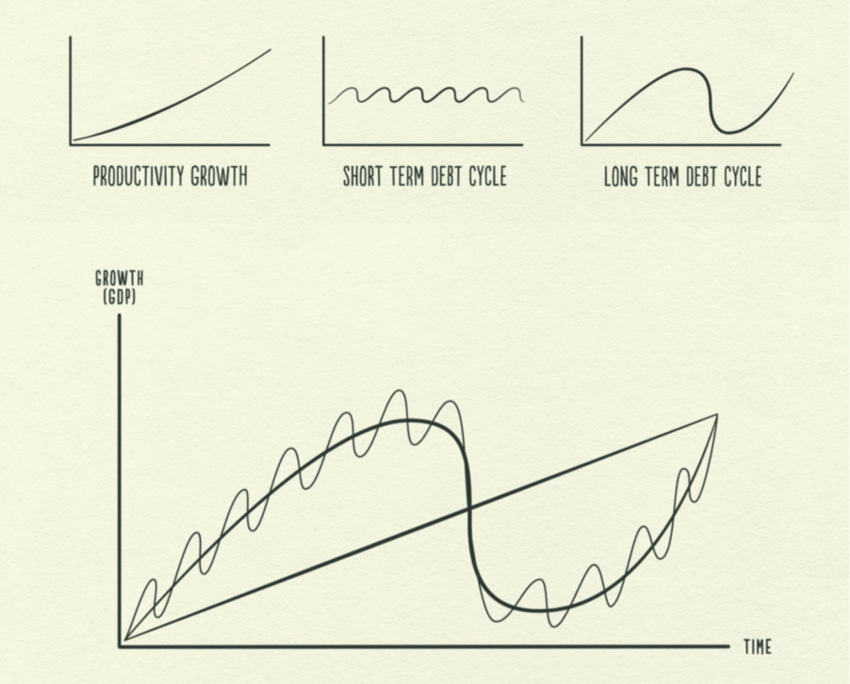

Ray states there are 3 fundamental forces within the “Economic Machine”.

Productivity Growth

Short-Term Debt Cycle

Long-Term Debt Cycle

If you lay these 3 forces on top of one another (as in the image below), you have Ray’s secret template for tracking economic movements and positioning yourself sensibly.

Transactions fuel the economy

The whole financial system is underpinned by transactions. These transactions see money and credit exchanged for goods, services, or financial assets, and it’s this exchange that drives the economy. While income and money play a large role, Ray says credit is by far the biggest, most volatile, and most important part of the economy (while also being the least understood). So, what is credit?

Credit

A pivotal part of the economy is borrowing and lending. Whether investing in education, starting a business, or buying something one cannot currently afford, such as a house or a car, credit allows participants in the economy to do things they wouldn’t usually be able to do. In simple terms, credit is debt that a borrower must repay in the future to do something they wouldn’t usually be able to do in the present. Awesome! So, it’s great for borrowers as they can spend more than they usually could (and get in crazy amounts of debt), but how does credit benefit those issuing the loans?

For the issuers of credit (usually a bank), it offers a seamless ability to stack more money. This is due to whenever a loan is agreed upon, borrowers must pay back slightly more than they borrowed. The initial credit that is agreed upon is known as the principle, and the additional amount the borrower must pay back is known as interest.

From this initial overview, we already have some key takeaways and terms:

Principle: Amount a borrower borrows.

Interest: Additional Amount borrowers must pay back.

High interest = Expensive to borrow.

Low Interest = Cheap to borrow.

Sweet. Simple stuff to begin with. But, how does this translate to monetary cycles, and why is credit so important?

Credit increases a borrower’s spending power, and spending is what drives the economy

It’s blisteringly obvious when you say it, but it’s often overlooked that one person’s spending is another person’s income. With the creation and issue of credit, a person’s spending can increase, meaning the amount that person is contributing to someone else’s income is also increasing. Put simply, when you spend more, someone else earns more.

If someone earns more, they become more creditworthy in the lender’s eyes, and banks are more willing to lend them more money. If credit increases, more money is spent and more money is earned by another individual. Spending is what fuels the economy, and credit fuels spending. So, is credit the secret sauce to neverending economic growth?! And is neverending debt the answer to all of your sorrows? Not quite.

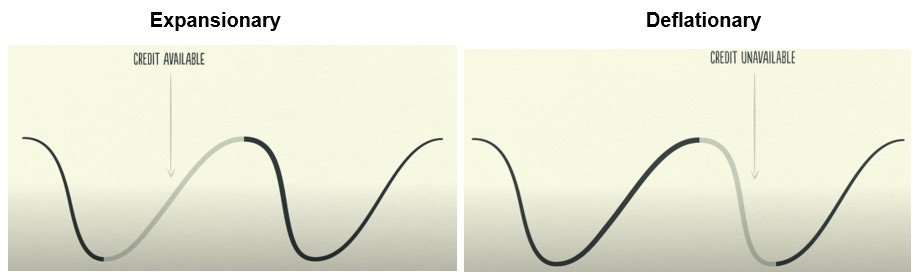

For a period of time, credit allows you to consume more than you produce. However, at some point, you must pay this back. When this point is reached the system does the old uno reverse, and you suddenly have to consume less than you produce. This then filters across the system: less money is borrowed, less money is spent, and less money is earned by another individual. Spending and incomes drop! If you plot this out over time, you see the cyclical nature of credit cycles. Just like energy flowing from the prison guard arm to the clang on the door, credit flows between individuals in expansionary and deflationary cycles.

Without credit, economic growth would resemble a far more linear line, with economic output directly tied to increased income and productivity, otherwise known as a productivity growth line. Hmm, smooth sailing growth based on productivity alone? Sounds pretty cool, right?

Credit is the fundamental reason we have economic cycles that cause far bigger booms, and busts. Credit buys assets, funds wars, and pays for goods and services. Ultimately, this continuous ebb and flow of debt begins to pile up, causing both short-term and long-term effects.

Short-Term Debt Cycle

As stated previously, as spending increases from the creation of credit (which unlike energy is created instantly from out of thin air) we see an 'expansion’ in economic activity (People spend more). If spending increases too fast relative to the increase in goods and services, the underlying prices of the goods and services rise. This is known as inflation.

For the next part of the story, we must add a new (rather shady) character into the mix known as the … Central Bank. A central bank is the financial institution responsible for managing a country's money supply, controlling interest rates, and overseeing the financial system to achieve certain economic and monetary policy objectives.

If spending increases too rapidly, inflation can rapidly rise. By vastly reducing the purchasing power of money, this can cause a lot of damage to the economy and the livelihood of everybody within. Here are the current figures for inflation in some countries. This percentage states how much the purchasing power of your currency is reducing each year. i.e. in the UK, £1 will buy 6.8% less in a year (would be worth 93.2 pence). Daylight robbery, ey?

United Kingdom - 6.8%

United States - 6.2%

Germany - 6.1%

Japan - 3.3%

Switzerland - 1.6%

China - 0.1%

So, what does the central bank do? To prevent rapid inflation, the central bank increases interest rates.

Remember from earlier that we said, “High interest = Expensive to borrow”.

With credit now far more expensive, people borrow less, start to repay loans, and ultimately spend less. The direct impact is that the amount of spending decreases, reducing the inflationary nature of overspending. The reduction in inflation is known as disinflation, if it reduces so far that it becomes negative, this is known as deflation.

If economic activity decreases too quickly, a country can enter a recession, where spending decreases, incomes drop, and unemployment rises. The central bank then needs to decrease interest rates to stimulate spending once again, starting the cycle once again.

In last week’s newsletter, we broke down exactly what a recession was. Check it out here.

One important thing to note is that at each cycle, the bottom of the cycle inverts slightly higher than the previous one. Why? It’s Human nature. Humans are greedy, and we have a tendency to always borrow and spend more than we really should. A debt-based economy feeds on that, offering the ability to never fully repay our debts, and become entrapped in a debt-based money system.

Because of this, over long periods of time, the overall debt in the system rises faster than overall income, forming big bubbles and creating something known as the long-term debt cycle.

Long-Term Debt Cycle

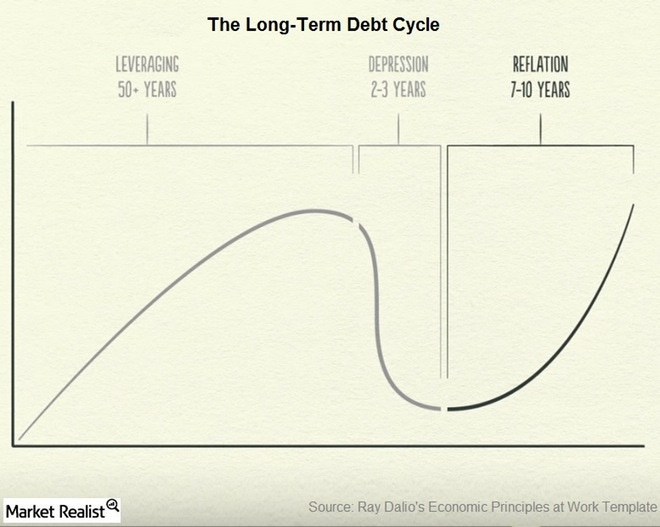

People have short-term mindsets and ultimately only believe what is currently happening will continue to happen. When the economy is booming, spending rampantly increases causing all financial asset prices to rise. With investors chasing those sweet gains, we see a further increase in borrowing to finance these purchases, causing the underlying asset price to increase even further! Equities, commodities, cryptocurrency, housing, you name it, these all increase rapidly. This is known as the leveraging phase and can happen over a span of 50 years.

Borrowers in the system feel wealthy! Even though they are taking on more debt, their income and asset appreciations offset the ongoing debt burdens and they continue to remain credit-worthy in the eyes of the lenders. Over long-term horizons, these debt burdens can build up immensely. It builds and builds and builds, and just like a bubble, it pops.

Deleveraging

A deleveraging happens. People cut spending, incomes fall, credit disappears, asset prices drop, banks get squeezed, the stock market crashes, social tensions rise and the whole thing feeds on itself the other way. Borrowers borrow to repay other debts, but with borrowers no longer credit-worthy, credit dries up and borrowers become unable to borrow enough money to make their debt repayments.

Borrowers are then forced to sell assets, flooding the markets, and tanking the price further. Unlike a recession, where the central bank lowers interest rates increasing debt creation, the rates are already as low as they can be. So, what is the solution? There are 4 steps to an economy solving a deleveraging.

Cut Spending

Reduce Debt

Redistribute wealth

Print money

1. Cut Spending

You may imagine that once spending is reduced, debts are repaid and the overall debt burden decreases. This is not the case. In fact, the opposite happens! Due to one person’s spending being another person’s income, the reduction in spending actually reduces the overall income in the system faster than debts are repaid. This deflationary stage results in businesses closing, jobs being cut, and higher unemployment. Sheesh. This leads to the next step number 2.

2. Reduce Debts

In this deleveraging, borrowers find themselves unable to pay their loans, leaving banks with unpaid debts. People begin to get nervous that the bank won’t be able to repay them and rush to withdraw their money, squeezing the bank. The result is that people, businesses, and banks default on their debts. This severe economic contraction is called a depression. Often to avoid this, a debt restructuring is agreed upon. With lenders either paying less back, paying over a longer duration, or at a lower interest rate.

However, this then leads to yet another problem. Like cutting spending, debt reduction is also deflationary. Lower-income and less employment mean the government collects fewer taxes, but at the same time, needs to increase spending and stimulus plans because unemployment has risen. In a deleveraging, Governments spend far more than they make. You may have heard of a term known as a “budget deficit.” So, how do Governments fund these increasing deficits?

3. Redistribute wealth

With a majority of the population unable to fund government spending, the Government must redistribute wealth from the haves to the have-nots. To do this, they increase taxes on the wealthy. Can you guess the result? The have-nots, begin to resent the haves, and the haves begin to resent the have-nots! If the depression continues, the tension can cause severe social and political change. In the 1930s this led to Hitler coming to power, War in Europe, and a great depression in the US. So, what’s the final solution?

4. Print money

With interest rates already at 0, the economy is left with one viable solution - Enable the money printer! By owning the printer keys, central banks began to print money out of thin air and buy financial assets and government bonds. This is inflationary and stimulative for the economy. But it must be balanced carefully; If this printing of money manages to offset the fall in credit, the economy can prosper whilst reducing the debt burden. This is known as the reflationary stage.

Reflation

If the rate of income growth grows faster than debt, without central banks printing too much money and causing hyperinflation, the cycle recovers and starts all over again.

Sheesh, so there we have it. We have analyzed the productivity growth line, the short-term debt cycle, and the long-term debt cycle, and you now know more than most people in the world (even creditors) about the debt-based economic machine.

Congrats! How do you feel?

To summarise, just like energy, money flows throughout the system from banks > issuance of credit > borrowers > goods and services > income > banks. This cyclical flow of spending (with credit) fuels short, and long-term debt cycles. Unlike energy, the monetary system has a unique fundamental law - money can be created. Debt creation is the essential lifeblood of the system, and while it does fuel spending and economic activity, it also causes huge busts that can devastate economies. The only solution is to print more money, and over time this causes purchasing power to slowly dwindle. Unfortunately for most, unless they understand the system, they often become trapped in the Economic Debt Machine.

Here are Ray’s key takeaways:

Don’t have debts rise faster than incomes - Your debt burdens will eventually crush you.

Don’t have income rise faster than productivity - Because you’ll eventually become uncompetitive.

Do all that you can to raise your productivity - Because in the long run that’s what matters most.

With all this in mind, where are we currently in the cycle? This newsletter is already pretty long, so I will briefly sum up a few resources for you.

P.S. If you made it this far, perhaps you could be so kind as to share or even hit the like button, It takes me a wee while to write all this. (It’s also free)

Here are some facts for you:

As of March 2021, The US spent $5.2 trillion on COVID. World War II cost $4.7 trillion (in today’s dollars).

All-in money printing totaled $13 trillion: $5.2 for COVID + $4.5 for quantitative easing + $3 for infrastructure.

That’s more than the US spent in its 13 most expensive wars combined.

Key takeaway? The US spent A LOT during COVID. Can you remember what the issue is with increasing the money supply too rampantly? Inflation. In June 2022, inflation in the US hit 9.2%. Since then, the central bank has been increasing interest rates to reduce spending in the economy. Many believe that due to the amount of money supply created, the sharp rate at which rates have been raised, and the amount of debt the US is in (over $32 trillion), we are about to enter a recession.

Recession Woes

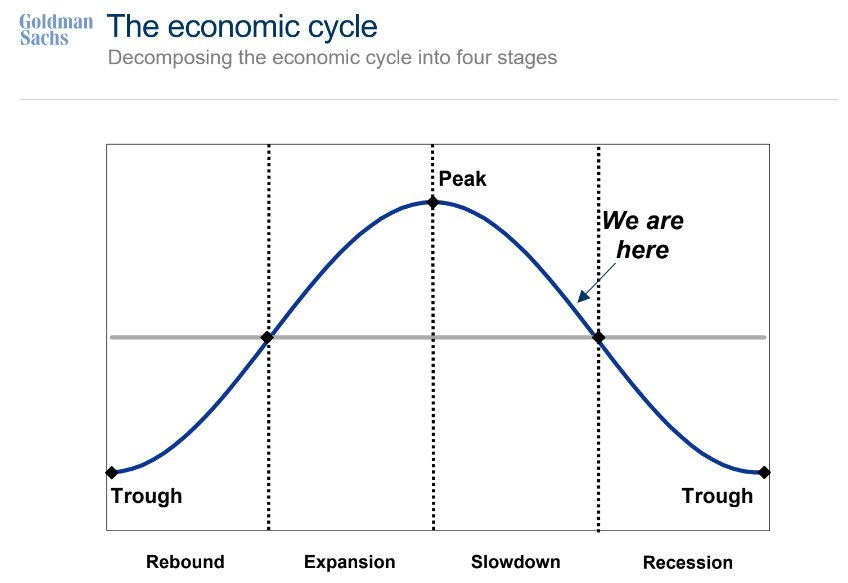

Aahan Menon is the founder of Prometheus Research. He states that this cycle has been rather unique and believes we are in the final innings before a recession (The downward slope on the short-term debt cycle).

He states this cycle is unique because in a normal tightening cycle, inflation is hot, so central banks curtail inflation by raising interest rates. Borrowers then deleverage and pay back their debts. However, during COVID, so much cash and treasury assets were pushed into the private sector, and due to the low-interest rates that users created debts with, they still aren’t deleveraging on the liability side. In other words, the net interest expense on the private sector side hasn’t actually risen that much.

Net interest expense = Gross interest expense (paying off credit) - interest income on assets (holding assets that pay interest like government bonds)

For example, while interest rates were so low during COVID-19 (at zero), a majority of low-yielding debt assets were created, such as mortgages at 2-3%. People are paying back those very low interest-rate loans they locked in, and are simultaneously receiving the high-interest-rate short-duration yields on treasury bonds. (Currently 5%!)

Put simply, the rapid increase in interest rates hasn’t actually curtailed spending yet, as many in the private sector are earning more from the interest on short-term assets than the long-duration loans they are paying back. Aahan says that this is the reason we have witnessed a slower pop to a recession, but believes that’s about to change. With profits falling and borrowing slowing, Aahan says:

Treasury will flood the market with bond issuance

The bond bear market is just getting started

Bonds will fall in price, yield will rise

Liquidity has remained robust but is about to collapse

Stocks will encounter trouble, too, as the economy slows & discount rates rise

Read through this document for complete data analysis.

The recession will start on October 1st

George Gammon predicts that another important economic credit caveat is about to hit millions of Americans. In fact, he states there is a 95.3% chance that we enter a recession on October 1st, 2023. He shares some facts:

61% of Americans are already living paycheck to paycheck

45% of Americans earning $100k or more are living paycheck to paycheck

So, what’s the major caveat? On October 1st, millions of Americans will start to pay their student loan. Out of the 45 million Americans with outstanding student loans, only 500,000 are currently repaying them. George then calculates that, on average the remaining 44.5 million individuals will need to pay an extra $400 every month and with so many living paycheck to paycheck, he says they will have to reduce spending, tipping the reduction in economic activity over the recession line.

The Recession play

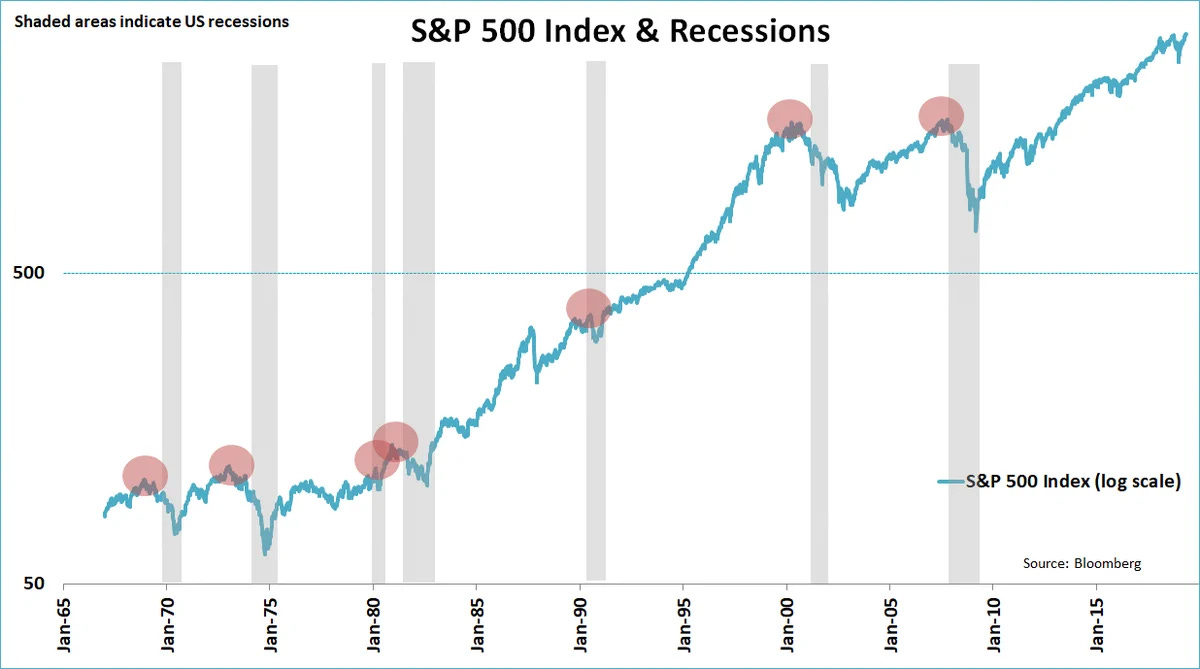

Firstly, you should understand that recessions are painful. Unemployment rises, spending drops, incomes fall, and real people struggle. As we outlined earlier, those with financial assets sell to fund their debts and livelihood. Therefore, in every recession, the value of stocks and cryptocurrency falls. The following chart outlines the S&P 500 during recession periods.

Outside of the two-month recession around the Covid pandemic, crypto has never experienced any legitimate economic downturn. At the start of the February 2020 Crypto recession, Bitcoin dropped over 60% in value. But, (and this is a big but) with the inevitability of the central bank needing to print money to reverse the chokehold of the recession, Bitcoin pumped over 1500% over the following year. If you look at the graph above, you can see how the S&P pumped out of every recessionary period.

So, what am I personally looking to invest in? Digital Assets. In next week's issue, I will break down why I believe certain digital assets are the asymmetric bet to make in the inevitable recession. We will discover what problems they solve and why their future growth is inevitable. I recently wrote a tweet on the matter. (click the image below).

Catch you next week!

🔥 🔥 🔥 Superb content that is easily digestible. Thank You

Unbelievable quality of information in this article! Wonderful work! Thank you.