The Trustless Economy - Understanding Ethereum

Explaining how game theory and decentralisation has led to Ethereum changing the financial system as we know it.

Humans are fundamentally reliant on trust for society to function. From personal relationships to global economic systems, trust is the glue that binds us together.

The great question is, how strong is that glue?

In small-scale settings, it can be highly sticky. This comes from the fact that trust is based on relationships, knowledge, and direct accountability, with a person’s reputation directly impacting the relationships they develop.

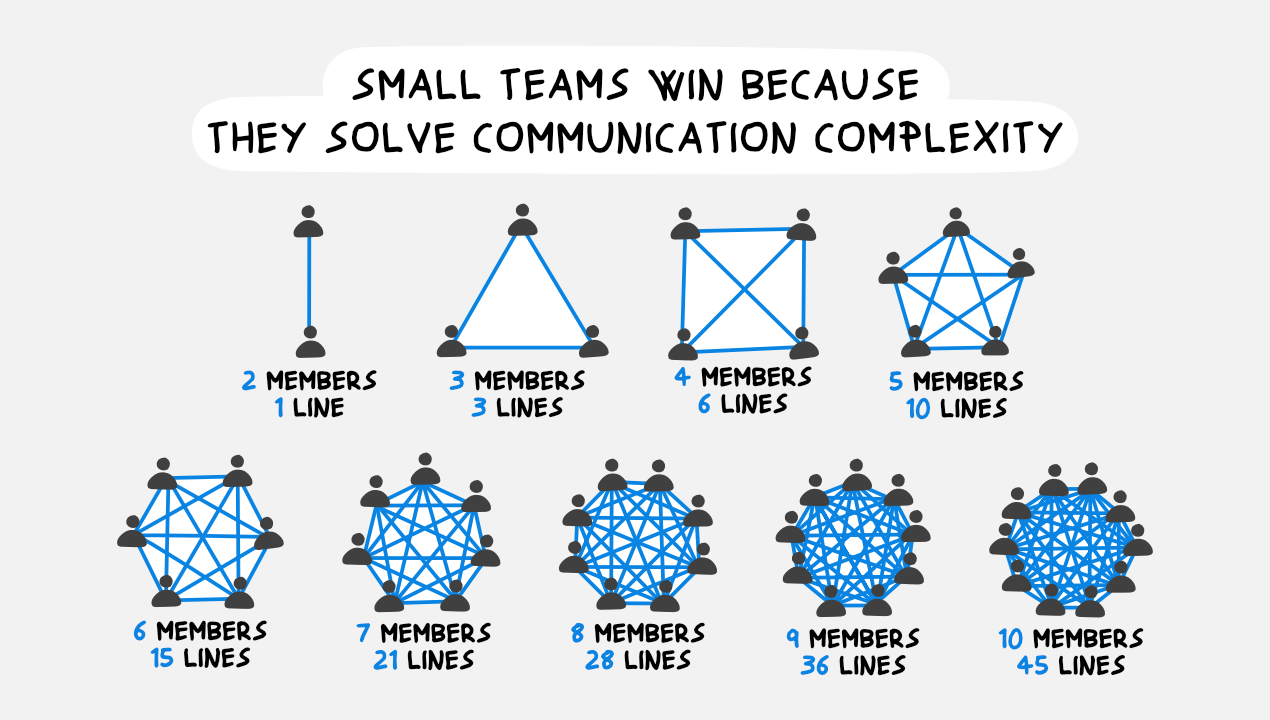

However, when the number of interactions increases and scales, the relative strength of trust becomes incredibly fragile to maintain. Why? The larger the group of people, the fewer interpersonal relationships forged, the less impact reputation has, the better the incentives have to be aligned and the better the system has to work.

Trust Stories

In the book "Sapiens," Yuval Noah Harari explains that trust can be maintained in groups of up to ~150 individuals, a figure known as Dunbar's number. When the group expands beyond this size, humankind relies on the development of shared myths, religions, and ideologies.

In today’s day and age, as the scale of relationships increases to larger organizations, corporations, or global markets, society’s solution is to institutionalize trust. In effect, crafting a narrative that certain individuals in the system are reputationally “trustworthy”.

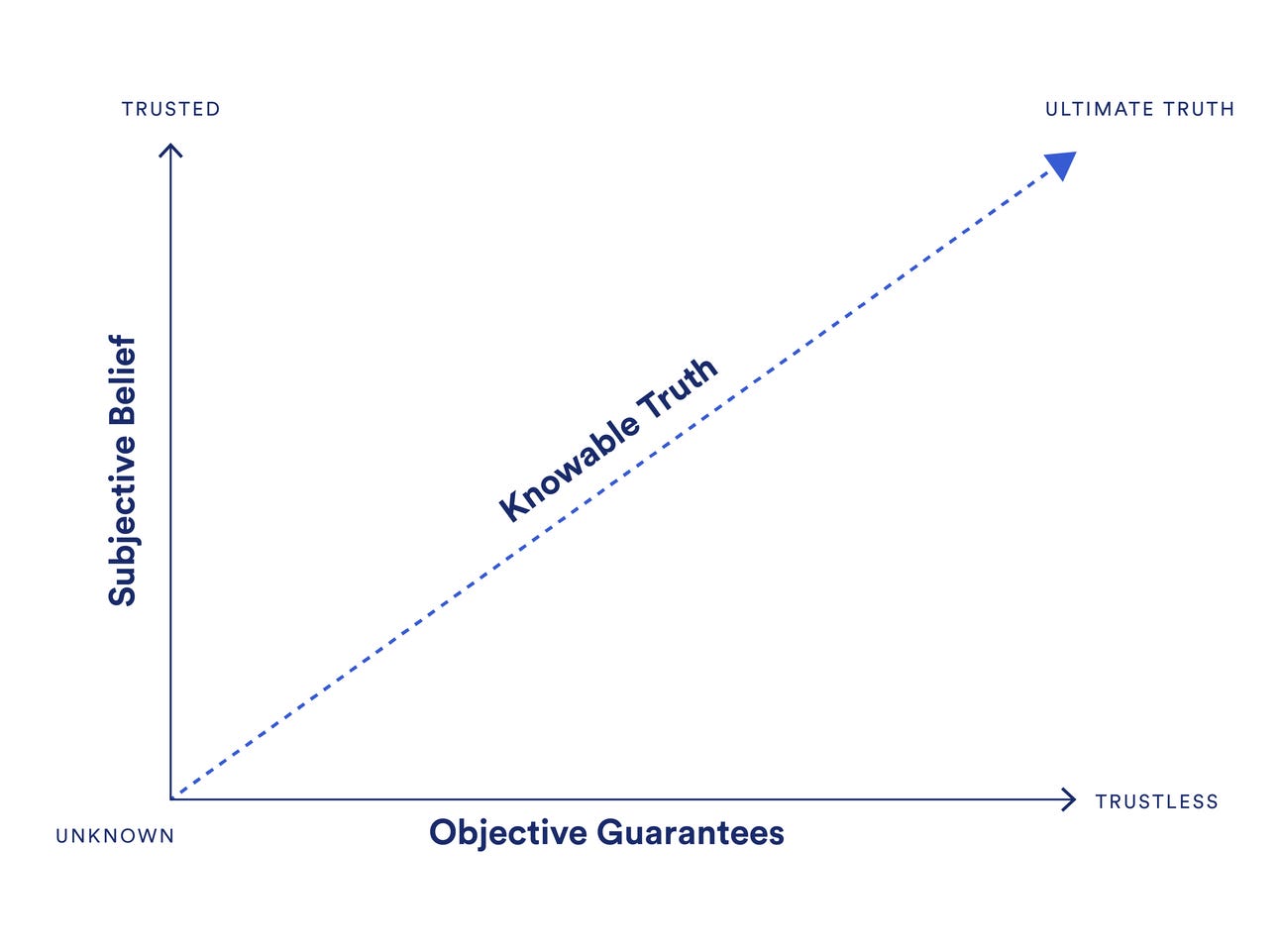

The image below shows one way to visualize this.

As simple as it sounds, this unsurprisingly doesn’t always work out…

In the 2008 financial crisis, financial products deemed incredibly safe (rated AAA) by these “trust-approved” banks and credit-rating agencies turned out to be the opposite. Banks had been wrapping dogshit in shiny wrapping paper and selling it as diamonds. Once people realized this, the system broke, catastrophically.

Stock markets plummeted, wiping out approximately $30 trillion in global equity market value. The U.S. housing market saw home prices fall by 30%, and over 3 million homes were foreclosed.

To grasp the enormity of a $30 trillion figure, consider this: if you stacked $1 bills, the height would reach about 2 million miles, or more than eight times the distance from Earth to the Moon. Or, if you spent one million dollars every. single. day. It would take over 82,000 years to spend!

The 2008 financial crisis is just one of the many, many times that trust has catastrophically failed and caused a system to cripple.

Enron Scandal (2001): Enron Corporation's fraudulent accounting practices led to its bankruptcy, eroding trust in corporate governance and auditing standards.

Wells Fargo Account Fraud Scandal (2016): Wells Fargo employees created millions of unauthorized bank and credit card accounts, leading to significant financial losses and a loss of trust in the bank.

Facebook-Cambridge Analytica Data Scandal (2018): The misuse of personal data by Cambridge Analytica, harvested from Facebook users without consent, highlighted the risks of centralized control over personal data.

Equifax Data Breach (2017): A major data breach at Equifax exposed the sensitive information of 147 million people, undermining trust in centralized credit reporting agencies.

The Great Game

Why do these trusted entities constantly break our trust?

Is it just an innate behavioral trait of all humans to be greedy, or is there mathematical reasoning? As it turns out, it’s kind of both.

Life is one big game. You roll the dice, move forward on the board, buy your house, collect $200 when passing Go, level up in skill sets, build alliances, make foes, and ultimately build and break trust. It’s a never-ending cycle.

To analyze life’s great decisions quantitatively, we can look to Game theory - a mathematical study of strategic interactions.

The most common introduction to this field is “The Prisoner's Dilemma” - a game where two individuals are arrested and held separately. They can either choose to cooperate and remain silent or defect and betray the other.

If both remain silent, they serve a short sentence. If one betrays and the other remains silent, the betrayer goes free while the silent one serves a longer sentence. If both betray each other, they serve a moderate sentence.

The dilemma illustrates the conflict between individual and collective rationality, showcasing how individual pursuit of self-interest can lead to worse overall outcomes for society.

If we map out this mechanic over many iterations and calculate the probabilities for success (adding points up), you may imagine that a society of defectors would begin to increase; as the age-old statement goes - nice guys never win.

The results, in fact, are quite different. Once this game was iteratively programmed into a computer and allowed to run thousands of times, with scores cumulatively added together, some interesting findings were discovered.

The most successful computer program was known as Tit-For-Tat and had the following traits:

Nice - Not the first to defect

Retaliatory - If your opponent defects, strike back immediately

Forgiving - Retaliate but does not hold a grudge

So being nice and trustworthy does benefit society?!

I mean, it makes sense - In almost all of life’s situations, one would be better off favoring cooperation. This is evident across team sports, interpersonal relationships, and within a business. The ones that work well together tend to be the best!

What I find particularly interesting is that another pattern emerges when mapped out over far larger time horizons and mapped into areas such as biological evolutions.

As Cooperative societies grow, they reach a point of instability due to any individual inclined to defect instantly upsetting the balance, and degrading interpersonal relationships (see above, Dunbar’s number). This is evident in the formation of cooperation within countries or businesses, the rise of an empire until it reaches maturity, and its inevitable decline once internal defection and unbalance ensue.

Put simply, in a team of nice guys, it only takes one bad actor to take advantage.

Evolutionary selection favors strategies that base the decision to help on the previous reputation of the recipient. In a small-scale setting, this is possible, but this has points of failure as the group increases beyond the 150 limits we previously discussed where reputation is based on a central authority.

To enable vast and advanced societies of cooperation there must be a supporting structure that allows for it. I, and many others believe that the global financial system and the livelihood of every member of society cannot solely rely on the ‘good word’ of those economically incentivized to manipulate the truth for their benefit.

Financial trust is begging to be redefined.

The Creation of Ethereum

Vires In Numeris

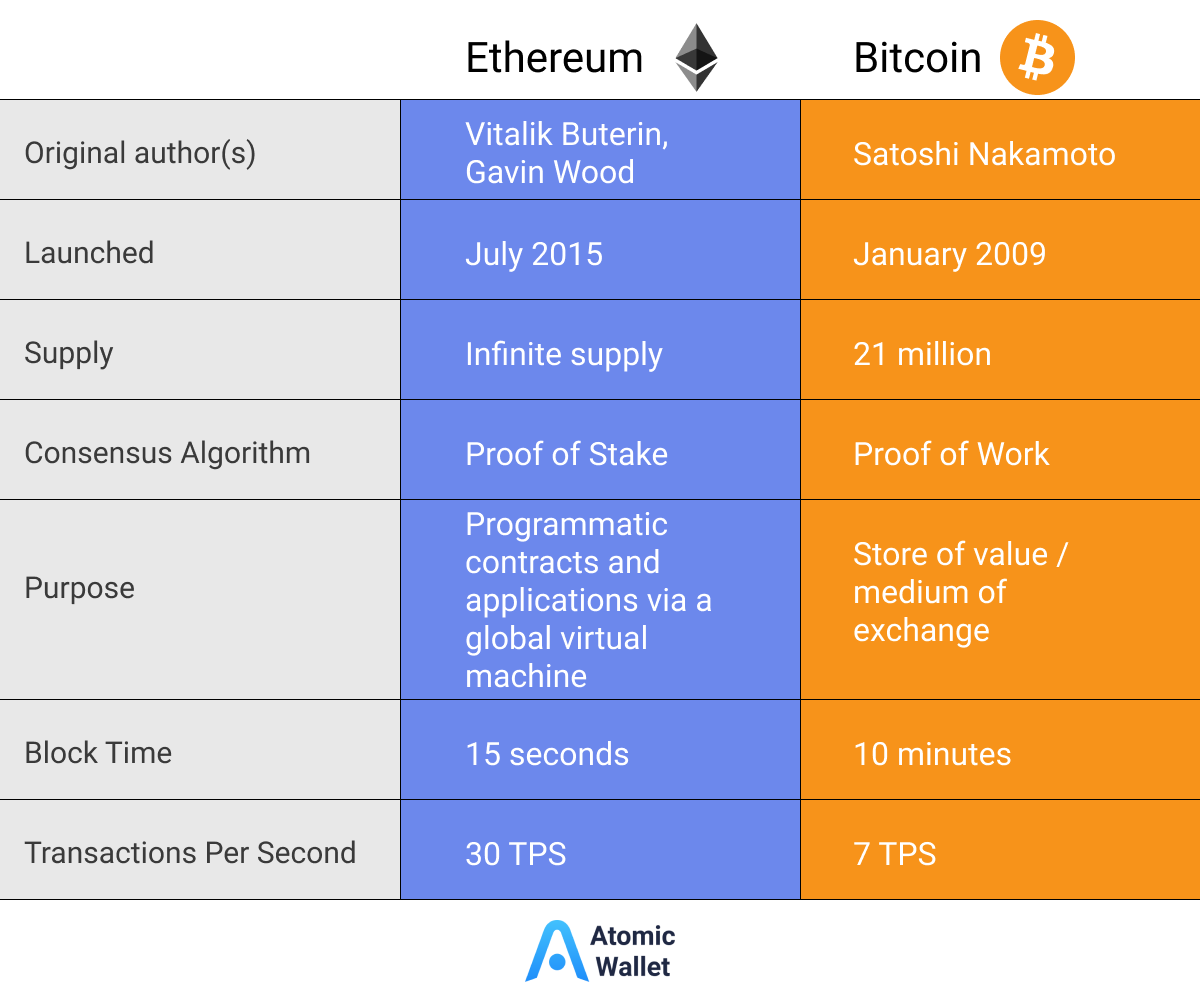

In 2009, Bitcoin was created; A financial model whose main aim was to remove trust from the financial system with an untampered monetary asset.

It aimed to do so with the introduction of a blockchain - a decentralized database, secured by a vast network of computers, and powered by a finite monetary unit - BTC.

Bitcoin is a peer-to-peer and cryptographically secure network. It allows all users to self-custody their own money and is governed by an emission schedule unable to be inflated at will by a single authority. These factors have led to Bitcoin being hailed as a fungible, digital version of gold.

Trustless Code

6 years after the creation of Bitcoin, Vitalik Buterin envisioned a more versatile blockchain. One which not only enabled users to hold and transfer a digital asset but also leverage the blockchain’s tamper-proof powers to create trustless applications and build decentralized sub-economies.

These statements may sound confusing at first, so bear with me.

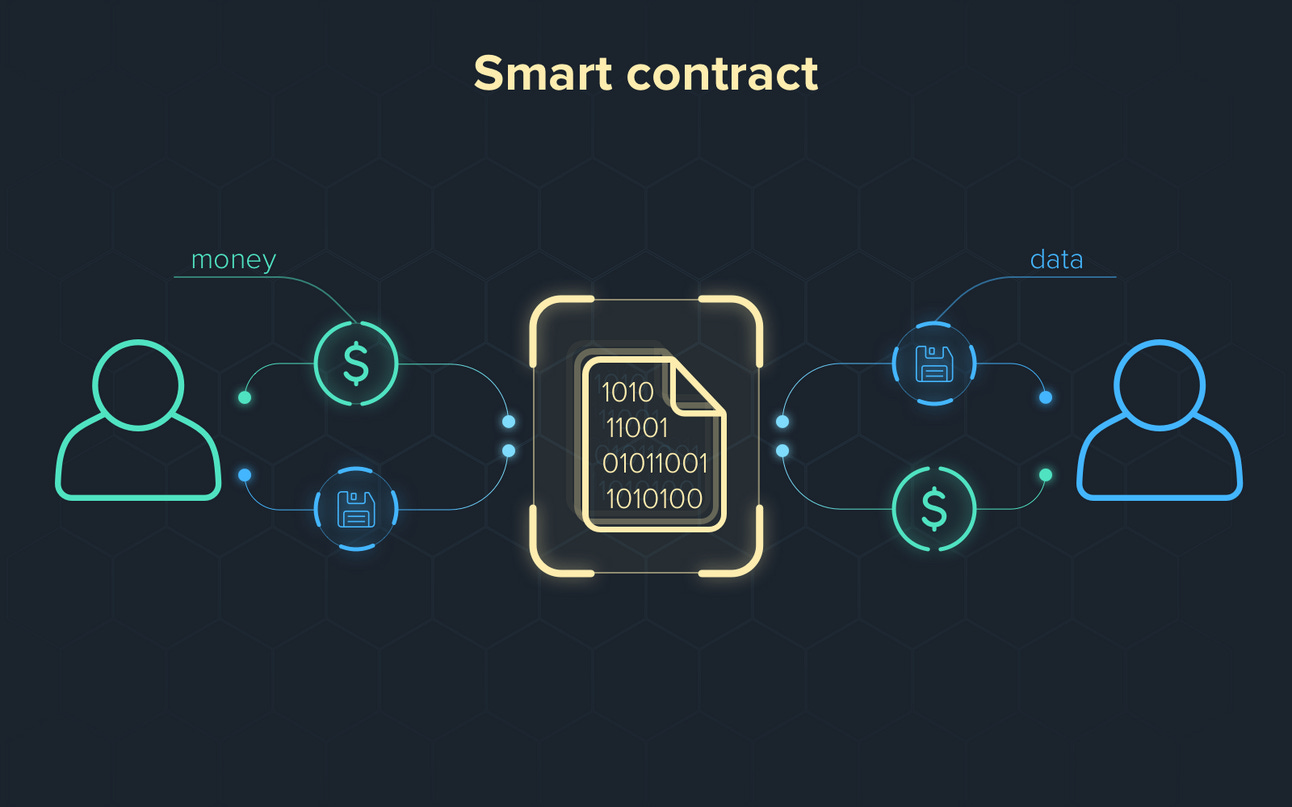

The most important thing to understand is that the core innovation around Ethereum was smart contracts.

A smart contract is a digital agreement that removes the need for human intervention by using code to automatically execute and enforce agreements based on predefined conditions.

They are made possible via some pretty cool blockchain features:

You could think of Smart Contracts as a recipe book that automatically crafts a delicacy when all the ingredients are provided. Once the code, or recipe in this metaphorical analogy, has been provided, no further human intervention is required.

The recipe is open source, meaning that everyone can check what will be made (and how it will be made) before agreeing to the contract. It is also immutable, meaning once deployed it cannot be changed.

Bitcoin vs Ethereum

If we are to look at both Bitcoin and Ethereum from a very high level, one could imagine the Bitcoin network as an incredibly secure calculator. Just as a calculator performs arithmetic operations, the Bitcoin network efficiently handles peer-to-peer transfers of value.

On the other hand, one could think of Ethereum as the Apple APP store - it provides a foundational platform for developers to build and run applications.

Just as the App Store offers a secure environment for apps on iPhones, Ethereum offers a decentralized and programmable blockchain environment for creating and executing smart contracts and decentralized applications (dApps).

To continue the analogy, while Bitcoin is a transactional network, Ethereum is the whole damn computer.

The World Computer

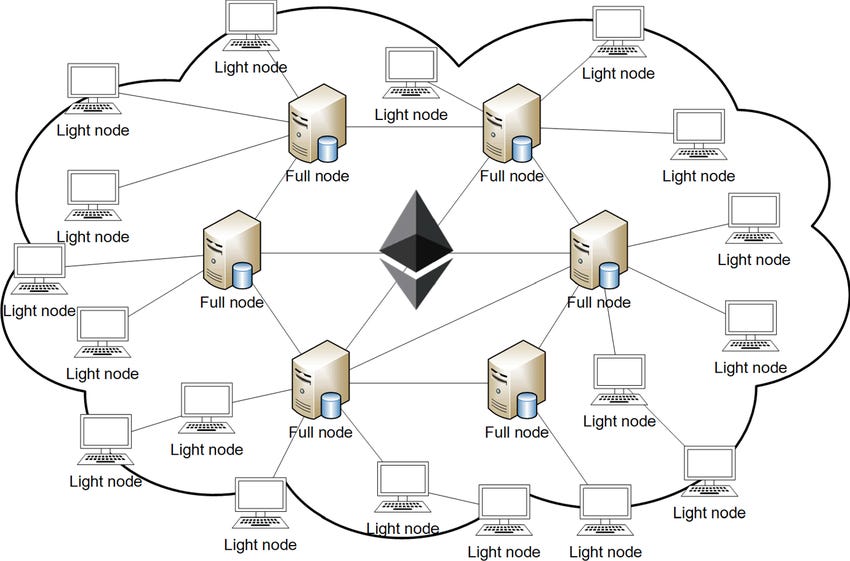

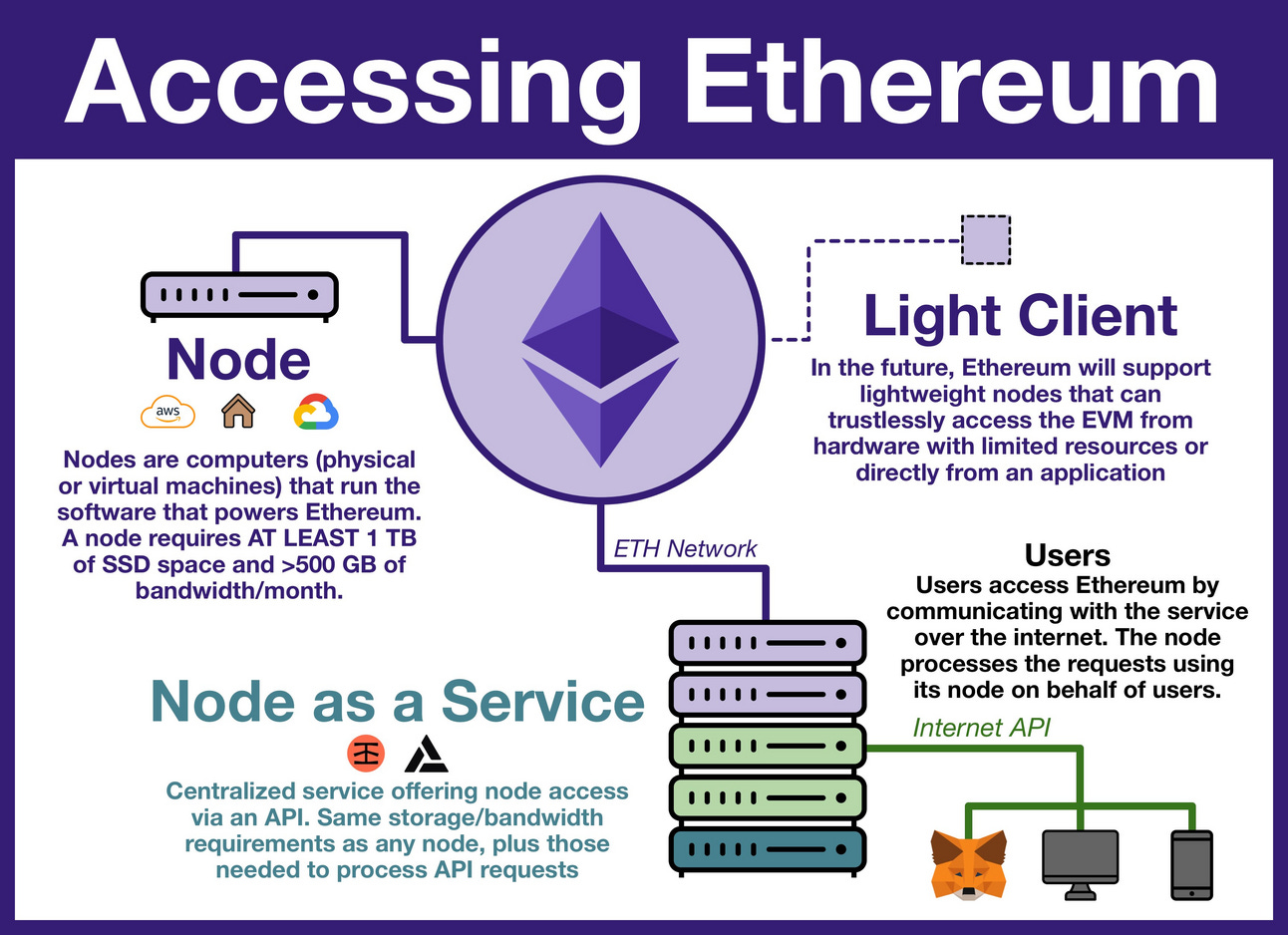

Unlike a traditional computer, where the state is achieved internally (the specific condition or status of a system or a piece of software at a particular point in time), the Ethereum computer, also known as the Ethereum Virtual Machine (EVM), functions by executing contracts across a vast network of computers.

When a transaction is executed on the Ethereum blockchain, the EVM ensures that every computer (or node) in the network processes and approves the transaction in the same way.

Every time a new set of transactions is added, it is called a “block” - hence the name blockchain. Public blockchains like Ethereum allow anyone to add, but not remove, data.

This network is powered by the cryptocurrency Ether (ETH), which is used to pay for the computational resources of transactions. Every transaction requires ETH to execute, meaning that If BTC is digital gold, ETH is digital Oil.

It’s important to note that when we say transaction, unlike the Bitcoin network we don’t explicitly mean someone sending funds. A transaction on Ethereum is anything that changes the state of the network, and due to the creation of Smart Contracts, it could be anything from deploying a new contract to voting on governance or purchasing a new item on an onchain Game. (more on this later)

Economic Security

One of the first questions that often comes to mind in regards to the Ethereum network is security. How do we ensure these smart contracts are safe?

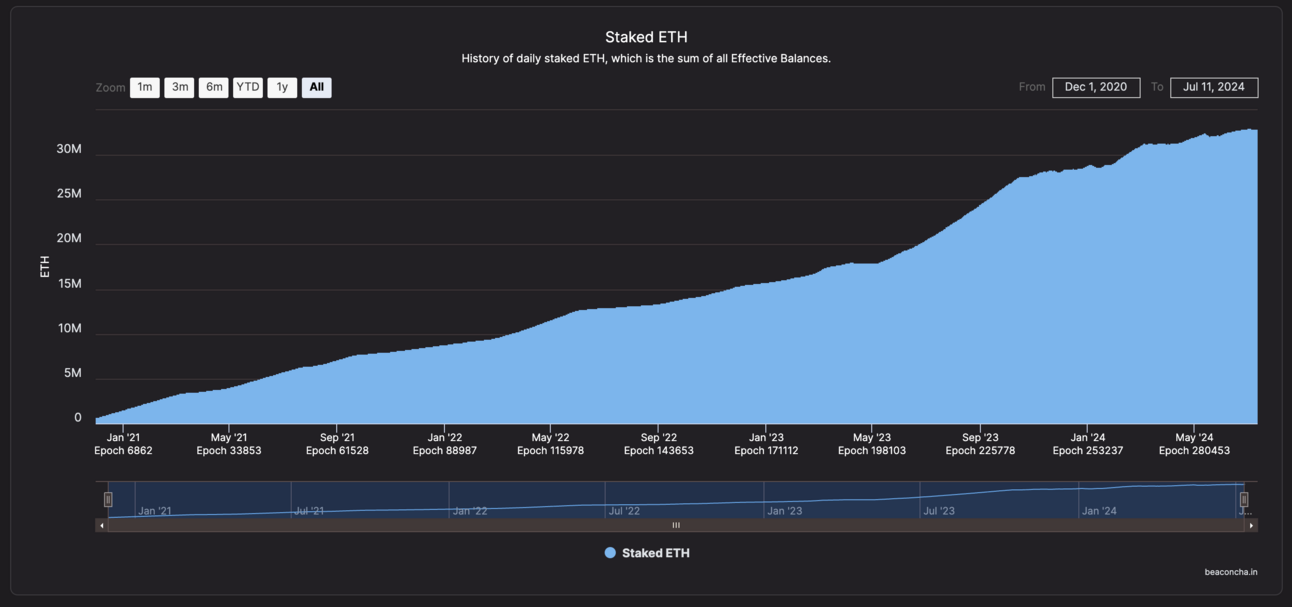

Ethereum is economically secured through a Proof of Stake (PoS) consensus mechanism.

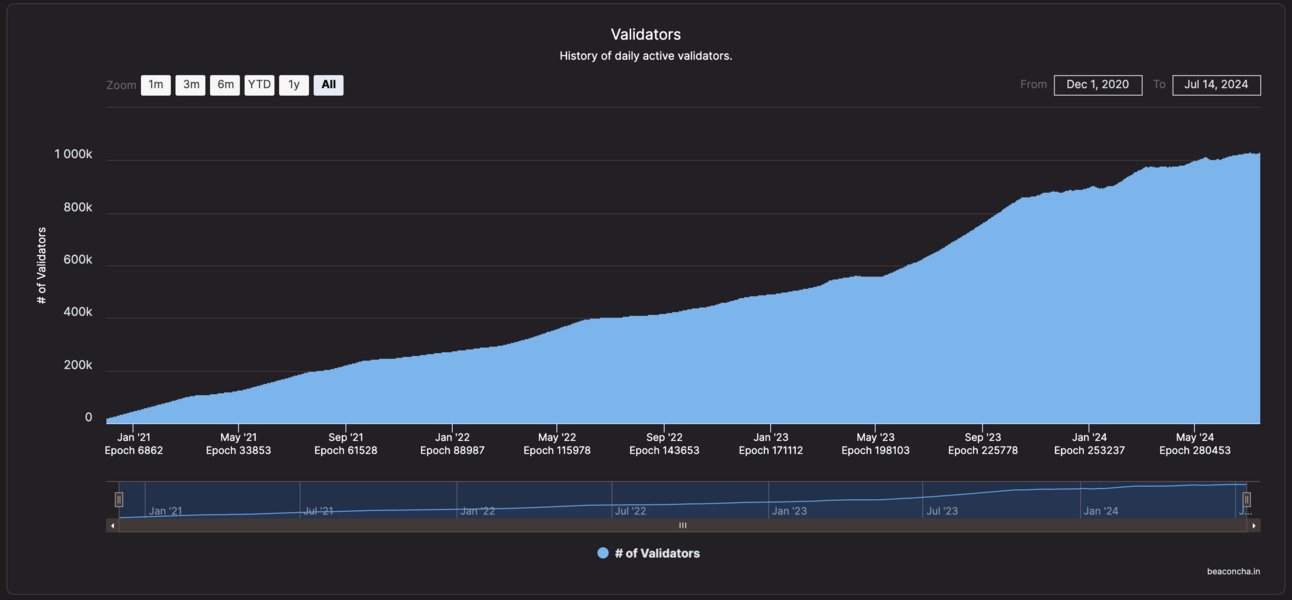

In PoS, the network state is changed via validators - participants responsible for storing data, processing transactions, and adding new blocks to the blockchain.

To become a validator, a user must lock up Ether (ETH) as collateral and run the necessary computational hardware to maintain and update the network state. To give an example of how a new block is added, let’s imagine 2 simple transactions occur within one block.

John sends 1 ETH to Betty.

Developer Bob spends 2 ETH to create a new smart contract.

The job of all validators in the network is to validate these 2 transactions and update the state of the network accordingly. In this example, validators need to ensure that John’s account decreases by 1 ETH, Betty’s account increases by 1 ETH, and a new smart contract is created and recorded on the blockchain.

Validators on the network update the state on their local hardware and once a majority (more than 50%) of the validators agree that the transactions are valid and the state changes are correct, the next block is added. This consensus mechanism ensures the integrity and accuracy of the network state.

If validators act dishonestly and lie about the state of the network (i.e. update their local computer to say that John sent 1 ETH to George instead of Betty) and more than 50% of the network participants say otherwise, they risk being slashed and losing a portion, or all of their staked ETH.

Validators also earn rewards in the form of newly minted ETH and transaction fees for their participation, providing a financial incentive to act in the network's best interest.

Put simply, participants are economically incentivized to secure the Ethereum network.

This 50% rule means that if someone wanted to alter any of the information or cheat the system, they’d need to do so with the majority (51%) of the computers on the network. A sum that would currently require ~103 billion dollars to do so.

A practically impossible endeavor for a number of reasons:

Market Liquidity: The Ethereum market lacks sufficient liquidity to handle a $103 billion purchase without causing extreme price volatility.

Exchanges: No single exchange or even a combination of exchanges can facilitate such a large purchase in one transaction.

Regulatory and Compliance Issues: A purchase of this size would attract regulatory scrutiny and require compliance with extensive AML and KYC regulations.

Counterparty Risk: Finding enough sellers to match a $103 billion demand for ETH would be nearly impossible.

The Programmable Economy

As we have learned, instead of just transacting and storing financial value, Ethereum allows for the creation and execution of trustless agreements based on a pre-defined set of instructions.

This means that while Bitcoin created a finite and decentralized monetary unit, Ethereum created the possibility of a new financial system.

Whereas previously intermediaries such as banks and lending agents have been required to interact in the financial system, Smart Contracts enabled the possibility of programming Decentralised Applications (dApps) that require no human intervention once deployed.

Decentralized Applications

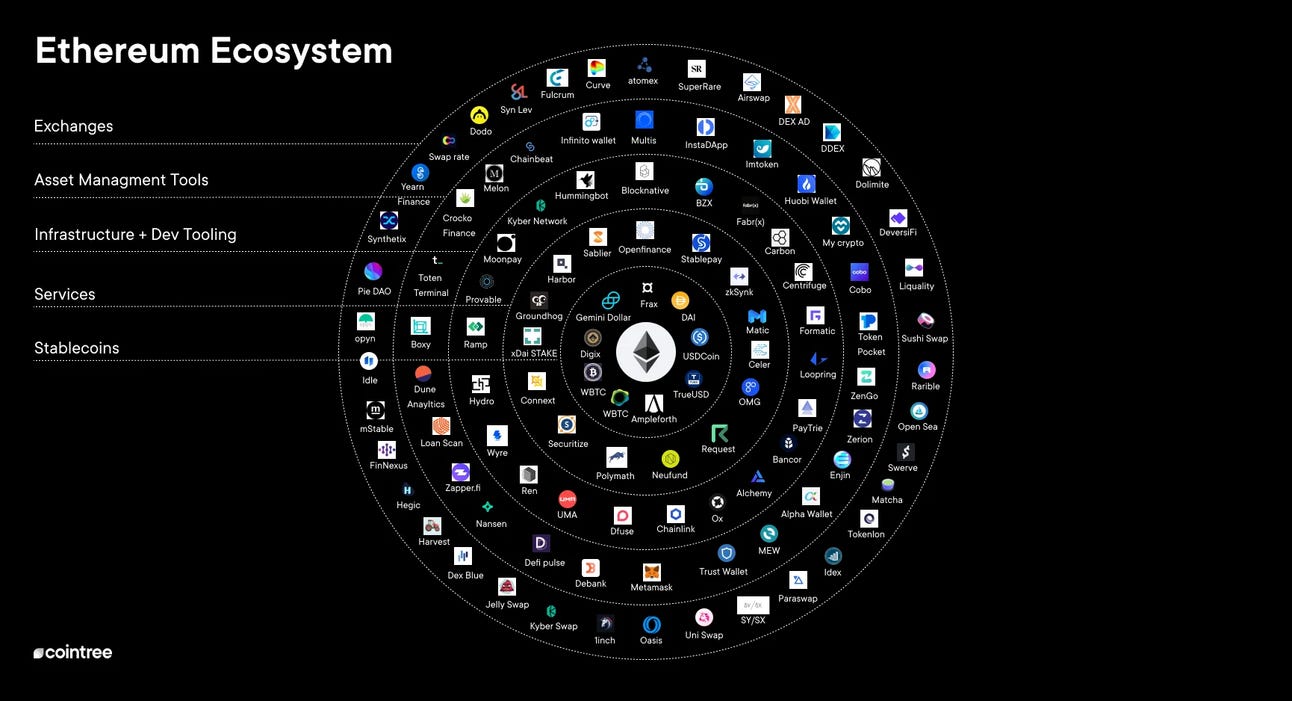

So what Decentralised Applications can be created?

Well, pretty much anything…

Anything that requires an agreement, middlemen, trust, and thus concentrated points of failure could utilize blockchain technology to decentralize and de-stress the system.

From supply chain management and healthcare to gaming and digital identity; the potential design space is infinite. Besides the ability to remove human intermediaries, the underlying technology is also an evolution in the efficiency and connectivity of data. By this, I mean that the siloed and archaic databases we have today seek to evolve into a far more efficient and connected technology layer.

So far, the sector that has gained the greatest traction is Decentralised Finance, or DeFi for short.

Decentralized Finance

Onchain lending markets unlock the ability for anyone with an internet connection to supply a tokenized asset and get paid interest by those who wish to borrow it. There are no middlemen that solicit or block the transaction, there is simply a piece of crypto code that predetermined interest rates via a mathematical model based on supply and demand mechanics.

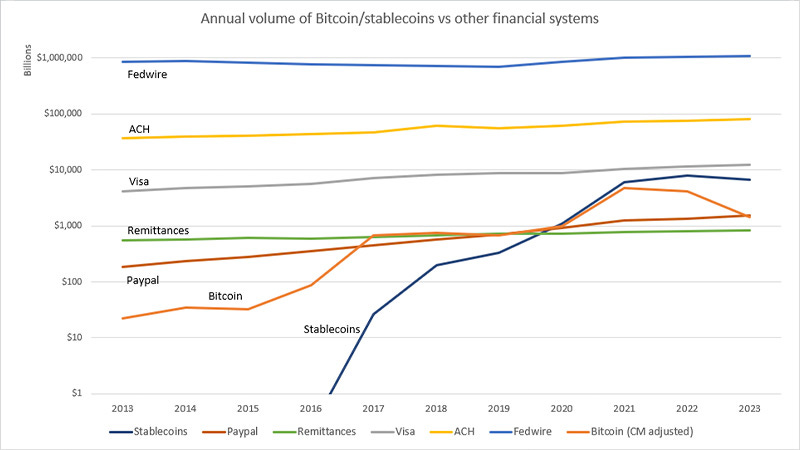

Stablecoins have been created to offer users a tokenized version of national currencies such as the USD and EUR - A $161b sector that has seen adoption from traditional financial giants like Visa and Paypal.

Backed by transparent offchain reserves (such as US treasuries) or pegged to the dollar but backed by ETH, stablecoins provide anyone, anywhere with instant access to an online and tokenized currency of their choosing.

This technology is particularly powerful for countries that have seen rampant inflation and devaluation of their currencies due to the greed and manipulation of a centralized set of powers.

For example:

Venezuela: Due to hyperinflation, many Venezuelans have turned to stablecoins like Tether (USDT) to store value and conduct transactions, bypassing the unstable bolívar.

Argentina: Facing high inflation and currency controls, Argentinians have increasingly used stablecoins to protect their savings and facilitate international trade.

Turkey: Amidst economic uncertainty and currency depreciation, Turkish citizens have adopted stablecoins to safeguard their wealth against the lira's fluctuations.

Let’s dive a little deeper into some of the most notable DeFi protocols.

Decentralised Stablecoins

The first dAPP built on Ethereum was Maker DAO, a protocol that allowed users to create and manage a decentralized stablecoin called Dai, which is pegged to the value of the US dollar but backed by ETH.

To obtain DAI, users would provide Ether (ETH) as collateral in a smart

contract. Once generated, bought, or received, Dai can be used in the same manner as any other cryptocurrency: it can be sent to others, used as payments for goods and services, and even held as savings to earn interest through a feature of the Maker Protocol called the Dai Savings Rate (DSR).

Lending Markets

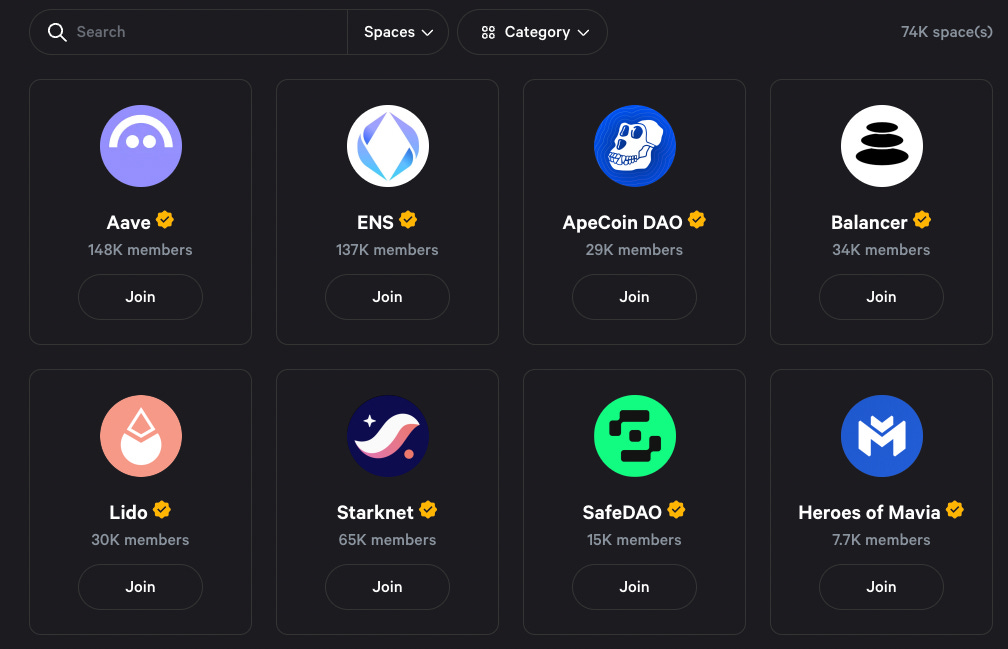

Aave is a decentralized non-custodial lending protocol where users can participate as depositors or borrowers. Depositors provide liquidity to the market to earn a passive income, while borrowers can borrow assets to utilize in another DeFi application.

Users supply their preferred asset and amount and earn passive income based on the market borrowing demand. Supplying assets then allows users to borrow by using their supplied assets as collateral.

Decentralized Exchanges

Balancer is a decentralized exchange (DEX) protocol that allows users to swap various cryptocurrencies directly from their wallets without the need for a central authority or intermediary.

Balancer uses an automated market maker (AMM) model, where liquidity providers deposit pairs of tokens into liquidity pools, and a mathematical formula determines the price of the tokens based on the ratio of the tokens in the pool. Users are incentivized to provide liquidity to the contract to earn a portion of all the trading fees generated by the pool.

Liquid Staking Protocols

Lido Finance is a decentralized finance (DeFi) protocol that provides a liquid staking solution for various proof-of-stake (PoS) blockchains.

Instead of locking up their cryptocurrency in a staking contract to secure the network, users can stake their assets through Liquid Staked Tokens protocols like Lido that will do so on their behalf and issue a liquid asset in return.

This approach offers users the benefits of staking—such as earning staking rewards—while maintaining the liquidity of their assets, enabling more flexibility and participation in the broader DeFi ecosystem.

Decentralised Autonomous Organisations

Thousands of financial applications have been formed on the ethos of Decentralisation, removing the power hierarchies that previously ruled traditional finance and replacing them with Decentralised Autonomous Organisations.

DAOs are organizations that operate on a blockchain, with rules and decisions encoded in computer programs rather than controlled by a centralized authority. Members of a DAO typically hold governance tokens that give them voting rights, allowing them to propose and vote on decisions such as fund allocation, treasury management, and project development.

This decentralized structure ensures transparency, as all actions and transactions are recorded on the blockchain, and it allows for a more democratic decision-making process where power is distributed among all members rather than concentrated among a few individuals.

The trustless economy

A lot has been spoken about, so let’s summarise and conclude.

Cooperation is a characteristic of every great society, yet as the group grows beyond the 150 number, the ability to create strong relationships diminishes and instead relies on narratives, stories, and centralized institutions.

While the formation of these entities has allowed groups to scale and build complex societal structures, it has also formed incredibly unstable organizations, with one bad actor able to take advantage of the collective for their benefit.

Game theory shows us that being a good guy is beneficial for the growth of society. It also shows that a society of all nice guys is at risk of proliferation by bad actors as evident if we look back at history.

To enable the next wave of vast and advanced societies of cooperation there must be a new supporting structure that allows for it.

What’s so interesting about Smart Contracts is that they don’t try to build a structure around an imperfect model, they completely redefine it.

I, and many others believe that the global financial system and the livelihood of every member of society cannot solely rely on the ‘good word’ of those economically incentivized to manipulate the truth for their benefit.

Do you?